Luxury Goods Insight: Brexit doubles the value of your Rolex. As part of Gentlemans Butler’s commitment to the luxury goods market we are delighted to hear some insight from Channel 4’s Four Rooms David Sonnenthal.

In the past six months, the value of Rolexes has gone stratospheric.

We are fascinated by the value of our nick knacks. Whether it’s an elite Ferrari that may be worth thousands more 1 hour after delivery or the general public’s curiosity with programmes such as The Antique Road Show.

There have been a number of luxury related documentaries on British television recently. One that you may have added to your viewing schedule is Channel 4’s Four Rooms where David Sonnenthal, currently appears. Channel Four’s profile says “David is the son of a diamond merchant and buying and selling is in his blood. He was awarded the Best Independent Pawnbroker award in 2008 by the National Pawnbroker Association. ‘There are three words to describe me he says: ‘The Deal Maker’. Dealing is in my blood, it’s all I know,’ he says.”

David is the founder of New Bond Street Pawnbrokers, a luxury, discreet pawnbroking service for the top end of the market, based in Mayfair: https://www.newbondstreetpawnbrokers.com/

With two decades in the luxury goods industry he says he has never seen anything quite like the state of the Rolex market in Britain right now. Their value is shooting up at an unprecedented rate.

The origins of this story can be traced directly to the morning of the 24th June. The Night of Brexit. It sounds like a trailer for an all action movie but no the action is one way and goes up.

On the morning of the 24th June, Britain voted to leave the European Union. This caused the value of the pound to decline sharply and is the primary reason for the sharp upturn in the cost of Rolex watches. The weakness of the pound against the US dollar has meant that American Rolex dealers have plundered the British market, snapping up watches that are effectively 20% cheaper.

Rolex owners in Britain were quick to cotton on to the trend, and decided to put their prices up to fend off any American buyers looking for a deal. The result is that the prices have effectively doubled, not just making up for the 20% deficit exploited by US dealers, but actually exceeding it.

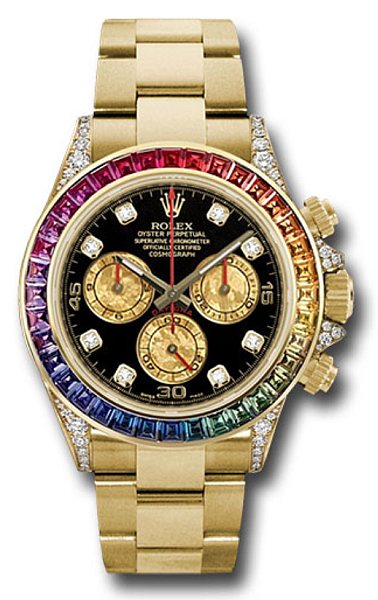

Let’s take the Rainbow Daytona as an example. This is an elite premium watch, the bezel inlaid with precious stones of various colours, set out to resemble a colour spectrum. This watch would typically sell for £60,000 before the referendum, but these days you’d be hard pressed to find one for less than £120,000.

The Rolex Submariner Sport is another example. Before the referendum, you could bag yourself one of these for £20-30,000. Now, you’ll have to pay £50-60,000.

This makes sense, with Rolex owners keen to exploit the situation too. If they put their prices up, American buyers will get the watches for a similar price to what they’re used to, and the British seller ends up with more money in their pocket.

Essentially all of this ensures that British investors looking to put their money in their first Rolex are price squeezed, however those who invested before the market ballooned are able to charge a premium if they want to sell up.

As David is a luxury goods dealer by trade, he notes that “when you spot a good deal for yourself you grab the opportunity with both hands”.

However, in his view, it’s really taken a lot of the fun out of the Rolex market in this country. In his 20 years working in the luxury industry in Mayfair, he has never seen such a sharp increase in the value of a particular brand over such a short space of time.

David comments.

Whilst you head out for a drive in the countryside its worth considering the future. New political developments could threaten to change all of this. The imminent ascension of Donald Trump to the most powerful political office in the Western world will certainly be a factor. When the results came in, confirming Trump as the president-elect, the value of the US dollar plummeted. Trump is yet to take office, so when he does in January next year, is the dollar due another drop? Only time will tell. In isolation, this would surely bring the US market back into check, and solve the issue. But the UK has its own political situation to deal with, that could complicate matters.

Prime Minister Theresa May has announced that the Article 50 – the piece of EU law that sets out the process for withdrawal from the EU – will be triggered by the end of March 2017. The UK’s vote to leave the EU caused a sharp decrease in the value of the pound, but if commentators are to be believed the triggering of Article 50 could be even more catastrophic.

Watch this space as the Rolex market could become even more volatile.

This is a Sponsored Post.

Please read more of our Luxury Watch Editorial click here …